Public Safety Operations Sales Tax

Public Safety Operations Sales Tax

Special Election Scheduled for April 11

In 2013, Pittsburg voters approved a public safety sales tax for ten years. This sales tax provides funding for our police and fire departments, and provides personnel, supportive technology, equipment, and training. This sales tax is set to expire in December 2023.

On April 11, a special election will be held to renew the half-cent public safety sales tax and continue it for another 10 years. If passed, this sales tax will not result in a tax increase.

For voter registration, advance voting resources, or other election information, contact the Crawford County Elections Division or visit the link below:

Public Safety Investments

The focus of the public safety sales tax is to increase personnel levels, with an emphasis on placing additional resources in patrol and creating specialty units; such as a crime analysis unit and a standalone narcotics unit. Funding is also used to replace antiquated equipment, particularly the city’s records management and dispatch systems. Funding has also been provided for the replacement of a 30-year old Fire Engine at Fire Station #1, replacement of the personal Self Contained Breathing Apparatus (SCBA) and protective structural firefighting bunker gear used by firefighters. The sales tax funding also provides necessary training for public safety personnel in emergency scene operations.

Since 2014, the city has made the following investments in public safety:

- Polygraph Machine

- Tasers

- Ammunition

- Software, GIS Aerial Mapping

- Investigations SUV

- Records Management System Software

- Network and Data Core Equipment

- Uniforms

- Vehicle Leases

- Special Response Team

- Bunker Gear

- Self Contained Breathing Apparatus (SCBA)

- New Fire Truck

- Training

Revenues

As of December 31, 2022

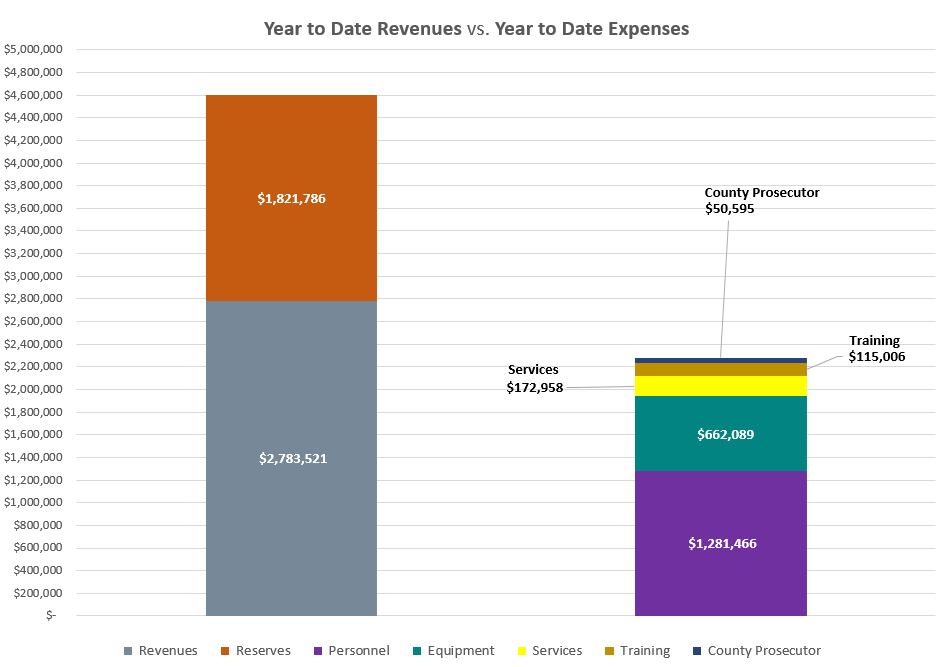

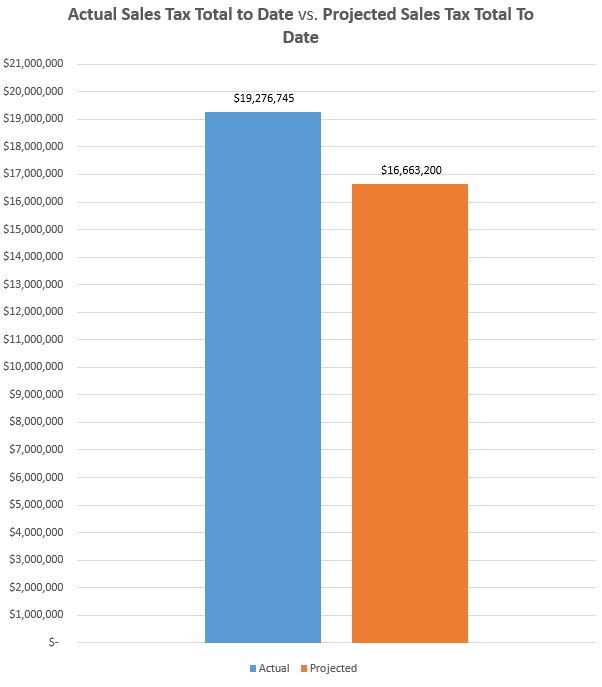

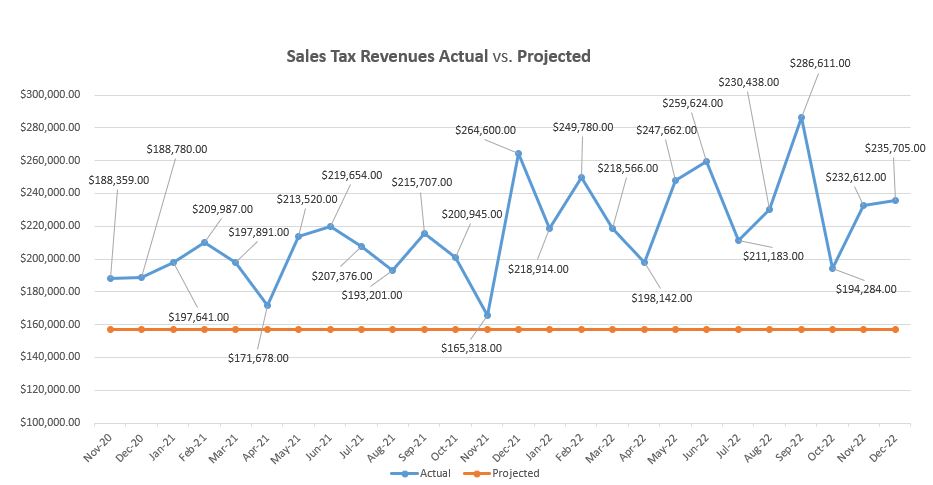

The sales tax collected from the Public Safety Operations Sales Tax is slightly higher than projected as seen in the graph below. The City started collecting the sales tax in March 2014. To date, the City has received $19,276,745 and the amount in reserves for 2021 is $1,821,786, which has been used to supplement the current year’s expenses. Below is how the current reserve balance is figured:

| Year 7 (2020) | Year 8 (2021) | Year 9 (2022) | |||

|---|---|---|---|---|---|

| Revenues | $2,217,135 | Revenues | $2,457,518 | Revenues | $2,783,521 |

| County Reimbursement | $15,096 | County Reimbursement | $15,096 | County Reimbursement | $15,096 |

| Reserves Year 6 | $1,028,387 | Reserves Year 7 | $1,431,809 | Reserves Year 8 | $1,821,786 |

| Expenditures | ($1,828,809) | Expenditures | ($2,082,637) | Expenditures | ($2,282,114) |

| Reserves | $1,431,809 | Reserves | $1,821,786 | Reserves | $2,338,289 |

Revenues vs. Expenses

The sales tax received from the Public Safety Operations Sales Tax for the current month is $235,705 and the expenses for 2022 are $2,282,114.